Top Gainers from RBI’s 50 Basis Points CRR Reduction

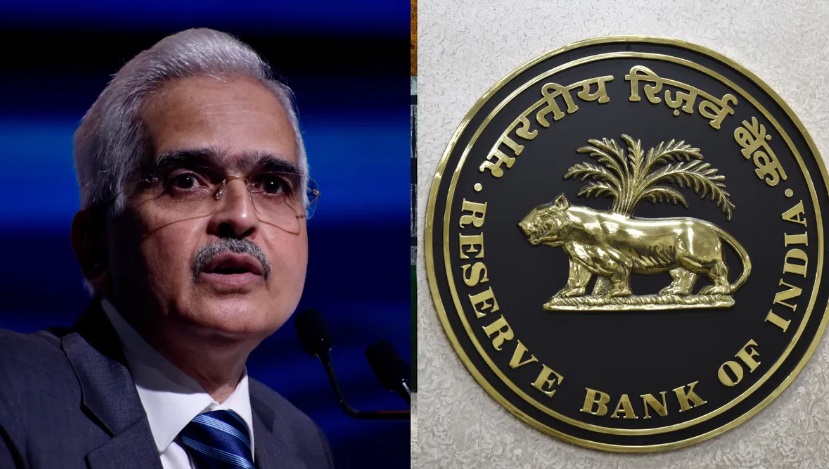

The Reserve Bank of India announced a cut in its Cash Reserve Ratio (CRR) by 50 basis points on Friday, December 6. Governor Shaktikanta Das said that this CRR cut will result in the release of liquidity worth ₹1.16 lakh crore into the banking system. Brokerage firm Citi released a note projecting the impact on the Net Interest Income or core income of banks post this CRR cut. Here is how individual banks will be impacted:

State Bank of India | India’s largest lender currently has a Cash Reserve Ratio (CRR) of 4.7% and a 50 bps cut will bring that figure down to 4.2%. Citi estimates a boost of ₹17,028 crore to the Net Interest Income of SBI post this CRR cut, which amounts to 0.8% of its annual Net Interest Income and 1.38% of its pre-provisioning operating profit.

HDFC Bank | India’s largest private lender currently has a Cash Reserve Ratio (CRR) of 6.3%, which will now come down to 5.8% post this 50 basis points cut by the RBI. This move will result in a boost of ₹9,257 crore to HDFC Bank’s core income, which is 0.66% of its annual NII and 0.78% of its pre-provisioning operating profit.

ICICI Bank | The second-largest private lender in the country currently has a Cash Reserve Ratio (CRR) of 5.5%. A 50 bps cut will bring this down to 5%. The RBI move will result in an increase of ₹4,867 crore to its Net Interest Income, which is 0.5% of its annual NII and 0.62% of its pre-provisioning operating profit.

PNB | The state-run lender has a cash reserve ratio of 4.4%, which will now come down to 3.9% post the RBI cut by 50 basis points. This cut will also benefit its Net Interest Income by ₹4,596 crore, which is nearly 1% of its annual core income and 1.67% of its pre-provisioning operating profit.

Bank of Baroda | The Public Sector Bank has among the lowest CRR’s among its peers at 3.7%, which will come down further to 3.2% post this 50 basis points cut by the RBI. This move will boost the bank’s Net Interest Income (NII) by ₹4,409 crore, which is 0.8% of its annual NII and 1.24% of its pre-provisioning Operating Profit.

The move to cut the CRR by 50 basis points will also boost the Net Interest Income of lenders like Axis Bank (by ₹3,830 crore), Kotak Mahindra Bank (by ₹1,464 crore), IndusInd Bank (by ₹1,372 crore), Federal Bank (by ₹879 crore), RBL Bank (by ₹368 crore) and AU Small Finance Bank (by ₹355 crore).