Congress Demands ICICI Bank Clarification on Sebi Chief’s Retirement Benefits

The Congress party has expressed strong discontent with ICICI Bank’s response to recent allegations involving Madhabi Puri Buch, the current chairperson of the Securities and Exchange Board of India (Sebi).

The allegations suggest that Buch continued to receive payments from ICICI Bank and its affiliate, ICICI Prudential, during her tenure as a whole-time member and later as the chairperson of Sebi, sparking concerns about a potential conflict of interest and a violation of office-for-profit regulations.

Congress fires fresh salvo

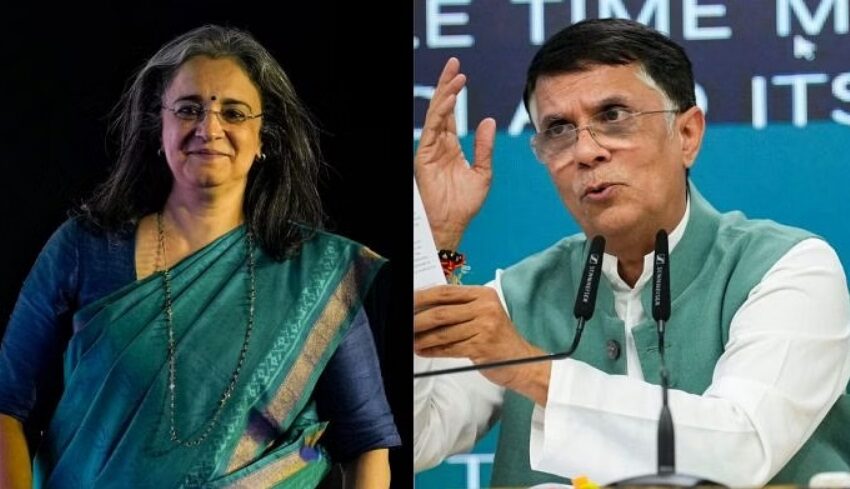

On Tuesday (September 3), Congress spokesperson Pawan Khera issued a statement questioning the bank’s explanation, suggesting that it unintentionally “confirmed” the party’s concerns. Khera highlighted several issues with ICICI’s response, particularly focusing on the nature of the “retiral benefits” that Buch allegedly received.

Khera pointed out inconsistencies in these benefits, questioning why the payments varied in frequency and amount, and why they resumed in 2016-2017 after being discontinued in 2015-2016, continuing until 2021. He also raised doubts about how a retiral benefit could exceed the salary Buch earned as an employee.

Further, Khera scrutinised ICICI’s claim that the bank allowed Buch to exercise employee stock option plan (ESOP) benefits for a period of 10 years. He questioned where this “revised policy” is documented and why it hasn’t been made public. Khera also queried why Buch was permitted to exercise her ESOPs during a period when ICICI’s share price was significantly increasing, which coincided with her tenure at Sebi, potentially benefiting her. Additionally, he asked if these ESOPs were sourced from the Employees’ ESOP Trust and whether this practice was fair to other ICICI employees.

Khera also expressed concerns about ICICI Bank’s handling of tax deducted at source (TDS) on Buch’s ESOPs, questioning why the bank covered the TDS on her behalf and if this practice is consistent for all employees. He further questioned why this TDS amount was not declared as taxable income for Buch, suggesting a possible violation of the Income Tax Act.

ICICI Bank’s clarification on Madhabi Puri Buch

ICICI Bank issued a statement on Monday (September 2) strongly denying the initial allegations. The bank clarified that Madhabi Puri Buch had not received any post-retirement salary or ESOP grants after her retirement on October 31, 2013, other than the benefits she was entitled to. The bank explained that any payments made to Buch post-retirement were related to ESOPs and retiral benefits accumulated during her time with the bank.

ICICI Bank also detailed that under its ESOP rules, retired employees are allowed to exercise their ESOPs up to 10 years from the date of vesting, with any resulting income being treated as perquisite income in line with Income Tax rules.

Initial allegations

Earlier on Monday, Khera had alleged that Buch received a total of Rs 16.8 crore between 2017 and 2024 from ICICI Bank, ICICI Prudential, ESOPs, and TDS on ESOPs. The Congress also claimed that Buch was drawing a salary from Sebi while adjudicating matters involving ICICI Bank, which raised questions of a conflict of interest.

Khera further claimed that Buch had relaxed regulatory norms for ICICI Bank during her time at Sebi, citing unverified reports. He also cited accusations made by Hindenburg Research, which claimed that Buch and her husband had stakes in offshore funds linked to the Adani Group, allegations that both Buch and the Adani Group have dismissed as baseless.