‘The power of holding equity’: SBI shares worth ₹500 bought in 1994 now stand at…

An X (formerly Twitter) user shared the valuation of SBI shares that his grandparents purchased in 1994 and expressed that he is planning to hold them.

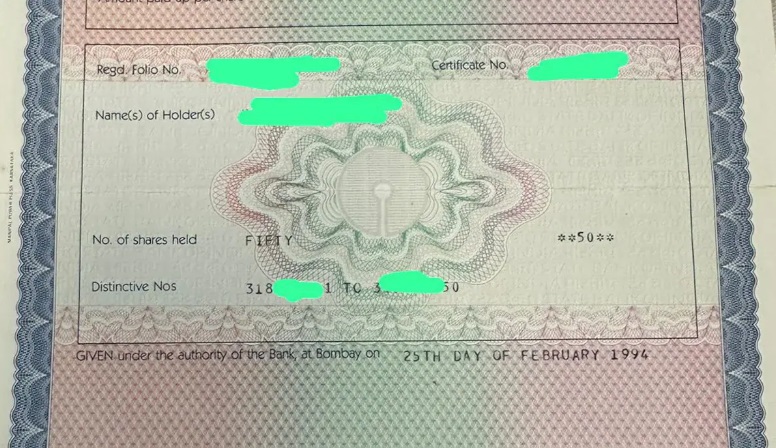

A couple had bought SBI shares worth ₹500 back in, but they had forgotten about them over the years. When their grandson was organising the family’s assets, he found share certificates from the State Bank of India. The shares, which were once forgotten, are now worth lakhs of rupees. The man shared the information on X, and, as expected, his post has gone viral.

“The power of holding equity,” wrote X user Dr Tanmay Motiwala while sharing a picture on X.

He added, “My grandparents had purchased SBI shares worth 500 ₹in 1994. They had forgotten about it. In fact, they had no idea why they purchased it and if they even held it.”

Motiwala further shared, “I found some such certificates while consolidating family’s holdings in a place. (Already had sent for converting them to Demat).”

After his post gained traction on X, many people inquired about the current valuation of SBI shares. “It is around 3.75L excluding dividends. It’s not a big amount, but yeah, it will be 750x in 30 years. Indeed, it is big,” he shared.

He also shared how he got his family stock certificates converted into a demat. “We actually took the help of an advisor/ consultant. Because the process itself is very painful and long (There may be spelling errors in name, address, signature mismatch etc). Even with an advisor, it took time but we have been able to do it for the majority of certificates.”

Motiwala further revealed that he is currently planning to hold these shares as he doesn’t need cash.

Both posts, since being shared, have received a plethora of views and likes. Additionally, many even flocked to the comments section to share their thoughts.

An individual shared, “I had forgotten Kotak’s small cap fund growth of ₹25,000 invested in 2005. I discovered through one paper 2 yes back – today it is 5,30,000 17.4% XIRR.”

“The real question is why is it valued so low after 30 years?” asked another. Motiwala replied and wrote, “Aur kitni valuation chaiye 30 years me? 750 times already. (Roughly between 20-25% CAGR). ₹500 hi the.”

A third shared, “How is it 3.75L? You have 50 shares, let’s say the per share price is 750, so 50×750 = ₹37500. Am I missing something? Your return in 30 years is from ₹10 to ₹750 = 75x, not 750x. That gives a CAGR of – 15.5%. It is a good return.”

“But considering the splits, it should be way more than this, somewhere around 2.25 crore,” wrote a fourth.