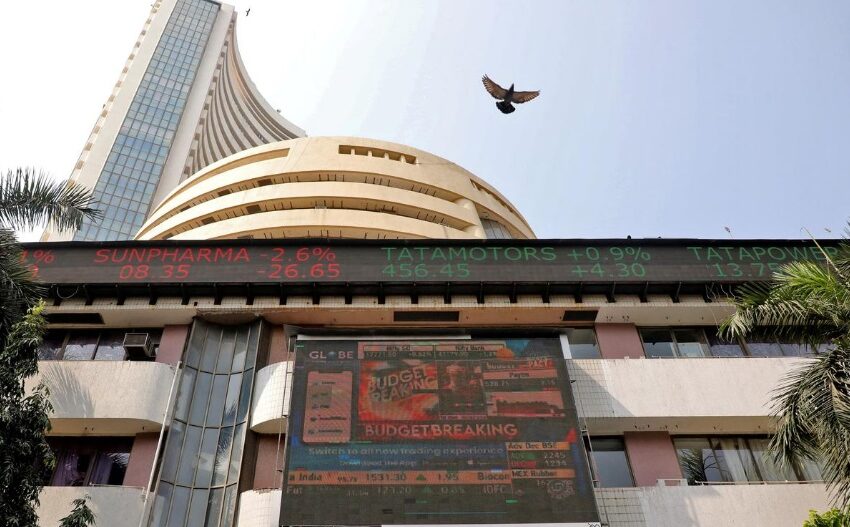

Sensex Sheds 500+ Points, Nifty Slips Below 25,100 Amid Renewed Tariff Threats

Benchmark indices pared early gains and slipped into the red on Thursday, with the Sensex falling over 500 points from the day’s high and the Nifty slipping below the 25,100 marks.

The equity benchmark indices pared early gains and slipped into the red on Thursday, with the Sensex falling over 500 points from the day’s high and the Nifty slipping below the 25,100 marks, amid weak global cues and renewed tariff-related concerns.

The Sensex opened higher and rose 145.9 points to 82,661.04 in early trade. The broader Nifty advanced 54.8 points to a high of 25,196.20. However, both indices soon turned negative, tracking sluggish global trends and fresh foreign fund outflows.

The Sensex was trading 539 points lower at 82,121.98 from the day’s high, while the Nifty quoted 175.8 points down at the day’s low of 25,020.40.

Infosys, Eternal, Tech Mahindra and Tata Motors were among the major laggards in early deals.

1) Renewed tariff threat: US President Donald Trump said he planned to send letters to trading partners in the next one to two weeks outlining unilateral tariff rates, ahead of a July 9 deadline to reimpose higher duties. “At a certain point, we’re just going to send letters out… saying this is the deal, you can take it or leave it,” Trump said in Washington. So far, only the UK has reached a trade framework with the US, along with a temporary tariff truce with China.

2) Tensions in the Middle East: The US is on high alert over the possibility of an Israeli strike on Iran. The State Department has authorised evacuation of some personnel from Iraq, and the Pentagon has approved the departure of military family members from various Middle East locations.

3) FII Selling: Foreign Institutional Investors (FIIs) sold shares worth Rs 446.31 crore on Wednesday, adding pressure on domestic markets.

4) Weak global cues: Key Asian indices such as Shanghai’s SSE Composite, Japan’s Nikkei 225 and Hong Kong’s Hang Seng were all trading lower, down up to 1 percent. US markets closed lower on Wednesday, and Wall Street Futures were also in the red on Thursday morning (IST).

5) Rising crude oil prices: Crude futures surged over 4 percent on Wednesday amid growing US-Iran tensions. Brent crude jumped $2.90 (4.3%) to close at $69.77 a barrel, while US West Texas Intermediate rose $3.17 (4.9%) to settle at $68.15.

Technical view

Anand James, Chief Market Strategist at Geojit Financial Services, said, “We are inclined to believe that the medium-term objectives of 25,460–26,200 continue to be in play, and upswings will unfold in the near term, as long as dips do not stretch beyond 25,056. Alternatively, a direct fall below 24,900/863 could signal weakness, though we prefer to see past 24,640 before switching sides.”