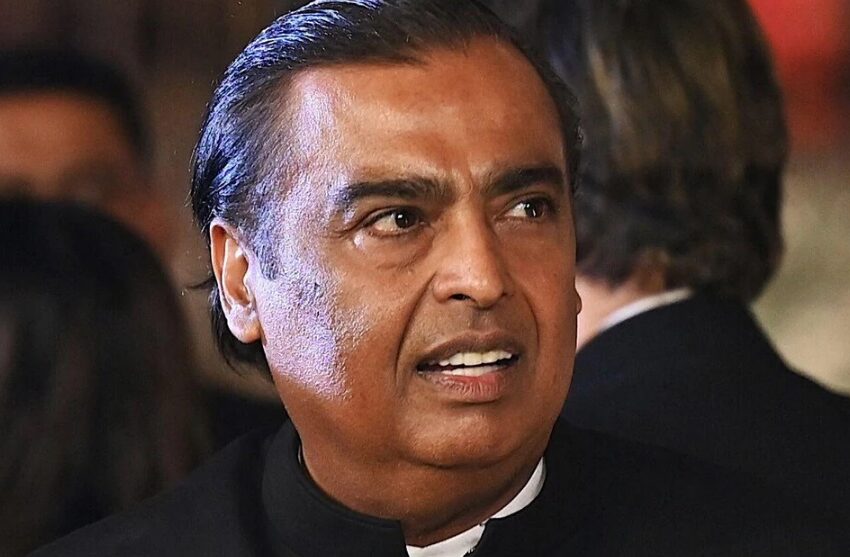

Mukesh Ambani’s Reliance Secures $2.9 Billion Loan in Major Global Banking Deal

Reliance Industries, owned by billionaire Mukesh Ambani, has secured a dual-currency loan worth the equivalent of $2.9 billion, according to a report by Bloomberg.

This marks the largest offshore loan raised by an Indian company in over a year. The facility agreement was signed on May 9, 2025. The loan is split into two parts: a $2.4 billion tranche in US dollars and a 67.7-billion-yen (approximately $462 million) tranche in Japanese yen.

About 55 banks participated in the deal, making it the largest bank group for a syndicated loan in Asia so far this year.

Reliance holds credit ratings above India’s sovereign grade

The conglomerate holds credit ratings of Baa2 from Moody’s and BBB from Fitch, placing it a notch above India’s sovereign credit rating, which stands at Baa3 from Moody’s and BBB– from Fitch. Both Baa2 (Moody’s) and BBB (Fitch) indicate that the borrower is stable and capable of repaying debt, though not in the top tier of credit quality.

India’s offshore borrowing hits $10.4 billion in 2025

This transaction has pushed foreign currency loan volumes raised by Indian companies to $10.4 billion so far in 2025—the quickest year-to-date pace in at least a decade, Bloomberg data showed. While syndicated lending in the broader Asia-Pacific region (excluding Japan) has slumped to a two-decade low of $29 billion in G3 currencies—US dollars, euros and yen—India has stood out.

Reliance continues investment push across core and new sectors

The latest borrowing comes as Reliance continues to ramp up investment across its diverse businesses. In his address at the company’s annual general meeting (AGM) in August 2024, Mukesh Ambani laid out an ambitious roadmap, stating the group aimed to break into the world’s 30 most valuable companies, up from its current position in the top 50.

Ambani credited this vision to the group’s increasing focus on deep technology and advanced manufacturing—areas in which Reliance has now become a technology producer in its own right. He also outlined bold plans for the company’s ‘New Energy’ division, projecting it to match the scale and profitability of Reliance’s traditional oil-to-chemicals (O2C) business within five to seven years.

The group also committed to major investments in biogas, plastics and polyester production. These include the establishment of 55 compressed biogas plants by 2025, a pilot project for an integrated energy plantation, and expanded capacity in polyvinyl chloride (PVC), chlorinated PVC (CPVC), and specialty polyester by 2026–27.

Reliance last raised $8 billion in offshore loans in 2023

Reliance had last tapped offshore loan markets in 2023, raising over $8 billion through borrowings by the parent company and subsidiary Reliance Jio Infocomm. Like the current deal, that round also drew in approximately 55 banks.

For the financial year that ended on March 31, 2025, Reliance reported record consolidated revenue of ₹9,64,693 crore, a 7.1 per cent year-on-year increase, supported by robust performance from its consumer and O2C segments. Net profit attributable to shareholders was steady at ₹69,648 crore.

The company also said it had become the first Indian corporate entity to post a net worth exceeding ₹10 trillion.