RBI and Economic Survey Align on Sub-7% GDP Growth Forecast for FY25

Earlier, the RBI saw GDP growth at 7.2 percent for the current fiscal, which was 20 basis points higher than the Economic Survey’s most optimistic prediction of 7 percent.

The Reserve Bank of India’s (RBI’s) massive 60-basis points cut in its GDP (gross domestic product) growth estimates for 2024-25 to 6.6 percent on December 6 brings its forecast closer to the finance ministry’s Economic Survey, which predicted that the economy could grow as little as 6.5 percent in the current financial year.

Earlier, the central bank saw GDP growth at 7.2 percent for the current fiscal, which was 20 basis points higher than the Economic Survey’s most optimistic prediction of 7 percent.

What led to the revision

This revision was necessitated by the economy slowing to its lowest levels in almost two years to 5.4 percent in the second quarter of the current fiscal, defying widespread expectations of a GDP print of around 6.5 percent during this period.

The central bank also revised its estimate for Q3FY25 to 6.8 percent from 7.4 percent and for Q4FY25 to 7.2 percent from 7.4 percent.

The RBI’s latest projection, if met, would mean that the country would fail to touch the 7-percent GDP growth mark for the first time in four years.

Interestingly, as recently as last month, Chief Economic Advisor V Anantha Nageswaran was quizzed about his estimates for growth in the Economic Survey for 2023-24 being pessimistic, compared to what is now the central bank’s earlier forecast of 7.2 percent for FY25.

To this, Nageswaran had said that while he is comfortable with his GDP growth projection of 6.5-7 percent for the current financial year, he would be “happy” if it were higher, rather closer to the earlier projection from central bank.

RBI not overly concerned about slowdown: Analysts

According to Rajani Sinha, Chief Economist, CareEdge Ratings, “while RBI will be cautious on growth, it doesn’t seem to be overly concerned. The central bank has highlighted that the slowdown in growth has been limited to a few sectors and overall growth is expected to pick up in the second half of the year.”

Crisil’s chief economist Dharmakirti Joshi agrees that the RBI sees the slowdown in the second quarter as transitory and localised to a few manufacturing sectors and expects things to turn better in the second half.

Though there were expectations from a few that the RBI’s Monetary Policy Committee may start the cycle of easing interest rates from December itself, given the Q2 GDP shocker, the central bank has seemingly given precedence to combating inflation by keeping the policy repo rate unchanged at 6.5 percent.

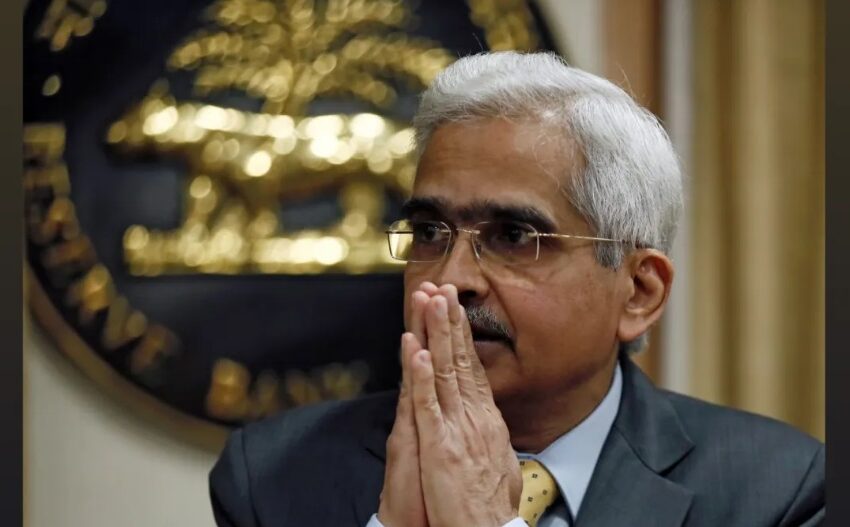

“High inflation reduces the disposable income in the hands of consumers and dents private consumption, which negatively impacts real GDP growth. The increasing incidence of adverse weather events, heightened geopolitical uncertainties and financial market volatility pose upside risks to inflation. The MPC believes that only with durable price stability can strong foundations be secured for high growth,” said the Governor Shaktikanta Das’s statement.

Retail inflation surged above the RBI’s upper tolerance band of 6 percent in October, driven by a sharp uptick in food inflation.

The central bank believes food inflation pressures are likely to linger in Q3 of this financial year and start easing only from Q4 of 2024-25, backed by a seasonal correction in vegetables prices, kharif harvest arrivals, likely good rabi output and adequate cereal buffer stocks.

Why not an accommodative stance?

Despite acknowledging the slowdown in growth, the central bank kept its stance neutral, which indicates that the RBI will be flexible in adjusting policy rates, based on prevailing economic conditions and is open to either increasing or decreasing interest rates, depending on the movement in inflation and GDP.

The RBI’s decision to not change the stance to accommodative also stems from the fact that it believes that the slowdown in the domestic economic activity bottomed out in Q2 of FY25.

An accommodative stance refers to a monetary policy approach where the central bank is inclined to ease interest rates to stimulate economic growth.

“The continued shift towards a neutral stance suggests that the central bank’s focus is gradually moving from inflation control to supporting growth. At this point, a rate cut would be more beneficial for consumers, including home buyers, as borrowing costs remain high despite the unchanged repo rate. The growth in home loans has slowed, and consumption among lower-income groups has significantly decreased, as witnessed in the sharp moderation in sales of affordable housing,” according to Shishir Baijal, Chairman and Managing Director, Knight Frank India.