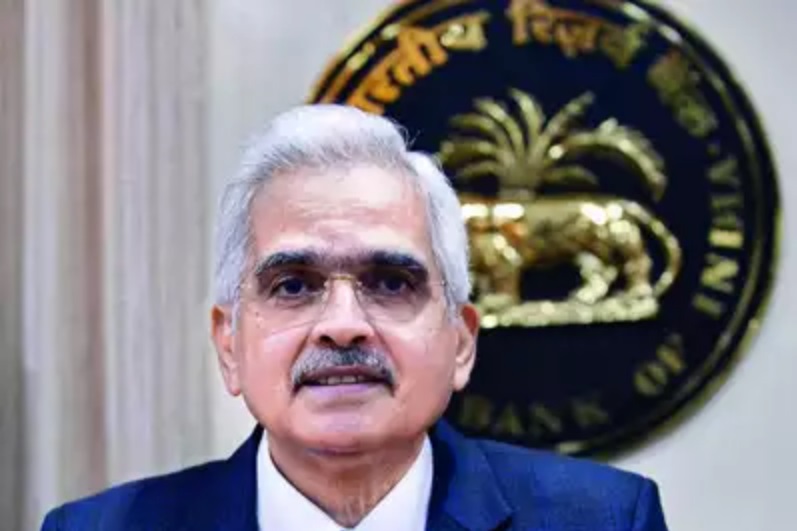

RBI Governor Shaktikanta Das: Offline Feature to Boost Digital Rupee

RBI governor Shaktikanta Das said offline accessibility, which is in the works, will make the digital rupee an attractive choice for retail users.

In addition, wholesale use of CBDC for trade in commercial paper and certificates of deposit in the debt market will also be extended by RBI, Das said in a panel discussion on central bank digital currencies at a BIS summit.

Das said that CBDCs have the same benefits as cash – anonymity and finality of settlement.

On anonymity, Das said it could be achieved either through legislation or by permanently deleting transaction data. He noted efforts to enable offline functionality, incorporate programmability for financial inclusion, and enhance technology scalability for broader adoption.

While there is currently a preference for UPI among retail users, Das was hopeful that offline and programmable CBDC will change this going forward.