Contrasting Views: Das Asserts RBI’s Independence from Fed, Economists Disagree

Beyond the lack of clarity on US Fed action, there are two more risks to the RBI’s timeline on rate cuts — the recent uptick in crude oil prices, and higher temperatures seen in April-June.

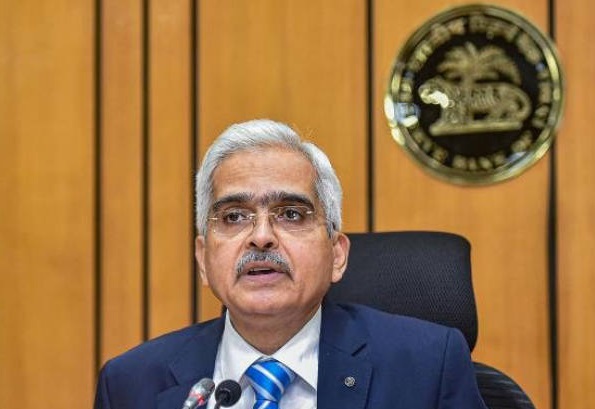

In the April Monetary policy, Reserve Bank of India (RBI) Governor Shaktikanta Das said the central bank is strictly guided by domestic factors on rate action and does not follow the US Federal Reserve.

However, a flurry of reactions from economists, following the RBI’s Monetary Policy Committee (MPC) decision on April 5 to keep real rates unchanged for the seventh time in a row, indicated the exact opposite.

A majority of economists see the possibility of India’s rate cycle turning in the later part of the calendar year, only after the US Federal Reserve starts easing rates.

“As long as India’s growth continues to be on a strong footing, the MPC may not see too much urgency to front-run the Fed, even as inflation eases back below 4 percent,” according to Shreya Sodhani, Regional Economist, Barclays.

Rajani Sinha, Chief Economist at CareEdge Ratings, spoke in a similar tone, expecting the RBI to go for a shallow rate cut later in the the year as domestic inflation moderates and US Fed starts cutting rates.

On April 5, Governor Das, while responding to a question during RBI’s post-monetary policy press conference, reiterated that the central bank’s action on rates in the past have, in fact, preceded US Fed action at times.

“Our policy is governed and determined primarily by domestic circumstances,” he added.

However, given that the evolving path of domestic inflation is more likely to be influenced by global developments, economists expect the RBI’s future rate actions to take into account external factors as well as the route taken by the American central bank.

Emkay Global economists Madhavi Arora and Harshal Patel explained this in an April 3 note. “We have long maintained that the RBI policy has been somewhat pegged to the Fed, specifically over the last two years, even as it formally targeted inflation. This seems fair, as external dynamics have been fluid, implying that the policy prerogative needs to be flexible for ensuring financial stability.”

Though the policy narrative has been explicitly domestic, swift policy turns or pivots in the last two years have been purely influenced by global factors, they added.

What makes the proposition that the RBI may not be keen on preceding the US Fed when it comes to a rate cut is the frequently shifting timelines of such a move by the latter.

Fed’s shifting goalpost

There are now growing expectations that the US Federal Reserve may cut interest rates later and fewer times than anticipated.

This is primarily due to a better-than-expected jobs data in March, among others, which indicated stronger growth for the American economy, thereby receding expectations of a reduction in interest rates in June.

The probability of a Fed rate cut in June has now declined to below 50 percent, from about 57 percent a week earlier, according to CME’s FedWatch tool.

This does muddy the waters for a rate cut timeline for the RBI as well.

Though most economists are pencilling in a rate cut by the RBI as early as August, it would, according to them, depend on the timeline of US Fed rate trajectory.

As Sodhani puts it, while the US economists expect the Fed to start cutting rate in June and thrice this year, risks do exist of a fewer or later cuts.

Two more risks to RBI’s rate cut timeline

Beyond the lack of clarity on US Fed action, there are two more risks to the RBI’s timeline on rate cuts — the recent uptick in crude oil prices, and higher temperatures seen in April-June, as pointed by the Governor himself.

Economists also see the trajectory of oil prices as well as monsoon in India to heavily influence the RBI’s take on when to cut rates.

Nimesh Chandan, CIO, Bajaj FinServ AMC, believes that the near-term movement in crude oil prices, the USD/INR trajectory and the timing and depth of the Fed rate cut cycle will have a bearing on the probable rate cuts in India.

Even Suman Chowdhury, Chief Economist and Head, Research, Acuité Ratings & Research, says that a possibility of a rate cut by the RBI in August 2024 also depends on clarity on the risks from Red Sea disturbance (which has primarily led to the uptick in crude oil prices), and the timely onset of South-West monsoon.

Brent crude prices have been flirting with the $90-per-barrel levels, which typically makes the RBI apprehensive about easing rates early. To be sure, oil prices fell nearly 2 percent early on April 8 as Middle East tensions eased, with Israel withdrawing more soldiers from southern Gaza.

But Brent crude futures still hovered around $89.47 per barrel in the early hours of April 8.

And, potentially firmer crude oil and heatwaves expected in several parts of the country for around three months, pose risks for food inflation, which remains elevated even as headline retail figure eased.

Though headline inflation remained steady in February, food prices edged up to 7.8 percent, driven primarily by vegetables, eggs, meat and fish.

Acknowledging these risks, Das on April 5 said that the central bank would monitor the trajectory of global oil prices as well as the impact of hotter summers on food prices, especially vegetables.

This seemingly led to the RBI keeping its FY25 inflation forecast unchanged at 4.5 percent.

India’s headline retail inflation remained largely unchanged at 5.09 percent in February, compared to 5.10 percent in the previous month. The Consumer Price Index (CPI) measures retail inflation by examining the changes in prices of most common consumer goods and services.

“Oil prices and geopolitical tensions creating supply shocks and/or increasing commodity prices were noted as the main upside risk. However, we think the (central) bank did not sound as alarmed on the recent surge in oil prices as we had expected it to, likely because global crude-price volatility has recently not impacted inflation due to government measures and access to cheaper Russian imports,” Barclay’s Sodhani said.

The downside risks to inflation aside, what has the RBI not rushing for a rate cut is India’s strong GDP growth outlook, thereby allowing the central bank to focus on bringing retail inflation down to the mandated 4-percent target.

While CPI inflation has extended its stay inside the RBI’s tolerance range of 2-6 percent to a sixth consecutive month, it has now spent 53 months in a row above the medium-term target of 4 percent.

As Das said, the outlook for growth allows space for the central bank to “unwaveringly focus on price stability”, since there is considerable vulnerability in food inflation.

Given the ever-evolving global developments and its bearing on local economic dynamics, it is not surprising that the RBI reiterated its commitment to achieving the last mile of disinflation as articulated by Governor Das with yet another metaphor – “We would like the elephant to return to the forest and remain there on a durable basis.”