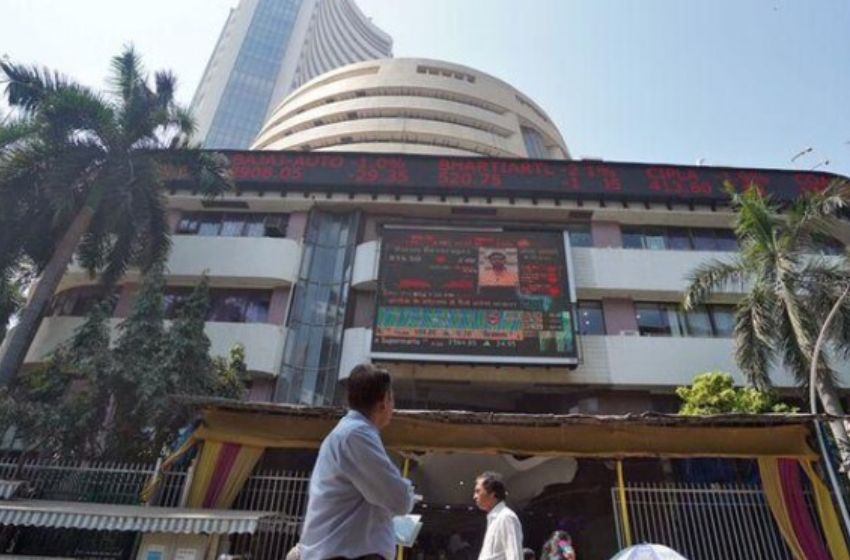

Sensex Up To More Than 200 Points; Reliance Industries, Tata Motors Hit Record Highs.

Reliance Industries, through its subsidiary Reliance New Energy Solar, will acquire a 40% interest in Sterling and Wilson and a 100% interest in REC Solar Holdings.

The benchmark indices are trading at all-time highs Monday afternoon, with the BSE Sensex hovering around 60,300 and the Nifty topping the 18,000 level, thanks to the strength of index heavyweights such as Reliance Industries, Maruti Suzuki, Power Grid Corporation of India, Kotak.

Mahindra Bank and Mahindra and Mahindra. At 2:26 p.m., the BSE Sensex is trading at 60,297.50, an increase of 245 points or 0.40 percent and the NSE Nifty is at 17,996, an increase of 92 points.

The broader markets are outperforming their large-cap peers, with the BSE Midcap Index and the BSE Smallcap Index gaining 0.7 percent each.

Meanwhile, following the historic privatization of Air India, the Secretary of the Department of Investment and Management of Public Assets (DIPAM), Tuhin Kanta Pandey, has said that the government will start working to monetize its other four subsidiaries, including Alliance Air, and more than 14.7 billion rupees non-essential. Assets such as land and buildings.

RIL has risen to a record 2,724 rupees on the BSE in intraday deals after the company acquired two companies on Sunday as part of its drive for clean energy.

Reliance Industries, through its subsidiary Reliance New Energy Solar, will acquire a 40 percent interest in Sterling and Wilson and a 100 percent interest in REC Solar Holdings.

Tata Motors is up more than 6 percent to a new 52-week high of ₹ 407.45 after the company said that according to its July guidance, wholesale sales for the second quarter of fiscal 22 totaled 64,032 units. (excluding the China joint venture).

On the other hand, TCS has plummeted 6 percent on the BSE after its second-quarter results. On Friday, the Mumbai-based company posted a consolidated net profit of Rs 9,624 million for the three months to September 30 from Rs 7.475 million a year earlier.

Infosys, HCL Technologies and Tech Mahindra also trade at losses of 1 to 2 percent each on the EEB.

The overall breadth of the market is positive, as 2,032 stocks were up while 1,367 were down in BSE.