Aditya Birla Group rejig may lead to Grasim-Nuvo merger

MUMBAI: After consolidating its garments business into a single entity last year, the $41-billion Aditya Birla Group is planning another round of corporate reorganisation to unlock value and beef up the balance sheet, at least three sources aware of the matter said.

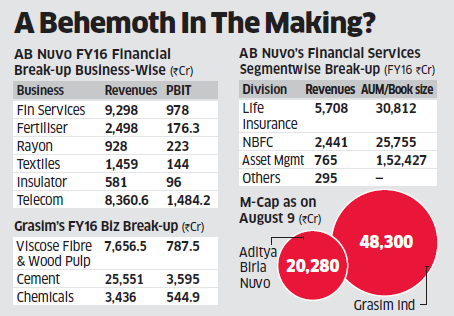

A part of this two-step restructuring may involve the merger of Grasim and parts of Aditya Birla Nuvo, which is likely to be followed by the hiving-off of the financial services business of AB Nuvo into a separate company.

A top source close to the transaction said discussions are evolving and that serious consideration is being given to the merger proposal.

While granular details are still sketchy, sources said one of the key motives behind this mega restructuring is to strengthen the balance sheet of Idea Cellular ahead of spectrum auction and the launch of Reliance Jio, which analysts expect will result in heightened competition and price wars.

A final announcement could be expected as early as this week. The boards of Grasim and AB Nuvo are scheduled to meet on Thursday for quarterly results.

An Aditya Birla Group spokesperson declined to comment.

If financial services is demerged from other businesses of AB Nuvo, it could unlock significant value for Nuvo’s shareholders, said analysts.

Nearly two-thirds of AB Nuvo’s revenues come from financial services.

Investment bank JM Financial is one of the advisers for the restructuring, a source added.

The merger and the complete reorganisation could involve a number of steps. A direct merger of Nuvo and Grasim and the simultaneous spinning-off of financial services business into a separate company is among the options.

The other option is to demerge the non-financial business of Nuvo, which includes carbon black and viscose filament yarn, into Grasim and turn Nuvo into a holding company for financial services, including life insurance.

This will make it easier for the financial services business to secure a partner.

Grasim’s holding in group company UltraTech could also be spun off separately, another source added. With holdings in the group’s financial services, telecom, fashion and lifestyle, and divisions of fertilisers, insulators, linen manufacturing and rayon, Aditya Birla Nuvo is positioned as a diversified conglomerate within the group.

Aditya Birla Financial Services (ABFS) is currently a 100 per cent subsidiary which houses the non-banking financial company, housing finance, asset management, general insurance advisory, private equity, broking and wealth businesses, among others.

The life insurance JV — Birla Sun Life Insurance — is however held independently under Nuvo as a separate venture. Nuvo also owns 23.3 per cent in Idea Cellular, the separately listed telecom venture, and 9 per cent in Aditya Birla Fashion & Retail as of the past financial year.

“Post the acquisition of Jaypee Cement, the UltraTech balance sheet is already stretched. But a combined balance sheet of Grasim and UltraTech can be leveraged substantially for future capex requirements of businesses,” said an official in the know on condition of anonymity as the talks are still in private domain.

As of FY16, Grasim and Nuvo have Rs 2,424.73 crore and Rs 890.94 crore cash in hand, respectively, as per ETIG database.

Following its merger with Aditya Birla Chemicals last February, Grasim has been positioned as a conglomerate. Grasim also houses the viscose fibre and chemicals businesses.

But most of its value is created by the cement business, which it derives from its 60 per cent stake in UltraTech. In the past fiscal, Grasim clocked total consolidated sales of Rs 36,217 crore and posted a net profit of Rs 2,359 crore.

As much as 21 per cent of sales came from viscose fibre, 9.5 per cent from chemicals and the remaining from the cement business. However, while valuing the company, analysts give only holding value to the cement business as Grasim holds shares of UltraTech and not the business.

So while UltraTech gets a market capitalisation of Rs 1.05 lakh crore with past 12 months net profit of Rs 2,475 crore, Grasim is valued at only Rs 48,000 crore on past 12 months net profit of Rs 3,103 crore.

The group’s cement business was split between Indian Rayon (now Nuvo) and Grasim in the 1990s before it was shifted completely to Grasim which in turn got merged with Ultratech.

Of the total AB Nuvo revenues of Rs 14,700 crore last fiscal, around Rs 9,200 crore was from ABFS. If all the businesses of AB Nuvo are valued separately, analysts arrive at a figure of approximately Rs 25,000 crore with Rs 19,000 crore coming from financial services. At Tuesday’s close, AB Nuvo’s market capitalisation stood at Rs 20,280 crore.

According to calculations by analysts, Aditya Birla Nuvo is trading at a 20 per cent holding company discount while Grasim is trading at close to 30 per cent holding company discount on Tuesday’s prices.

Idea Cellular recently said it has over Rs 4,000 crore on its balance sheet and generates between Rs 11,000-12,000 crore of free cash each year. On Monday, Idea’s chief executive said the company was transforming from a voice services into a voice and data player, and that its investment in airwaves will be based on this.

However, a person familiar with developments at Idea Cellular said the merger plans have nothing to do with the telco’s participation in the auction or any other plans.

“RJio’s entry in 2H16 will likely increase competitive intensity; voice tariff hikes could be tough,and data ARMBs could fall further.

Incumbents face the risk of data cannibalizing voice,as well as margin pressure with rising competitive intensity. Idea, with relatively smaller balance sheet, is at higher risk. Potential spectrum auctions put earnings at risk as well,as they imply higher leverage,”said analysts Vishal Jaisingh and Amruta Pabalkar at Morgan Stanley on Aug 8th.